Get your business up and running on QuickBooks Online or Desktop and have a quick reference always handy for yourself or employees. From setting up a company to depositing customer payments and creating professional quality financial statements, QuickBooks offers the accounting tools you need to stay on top of business finances 24/7. This flexible software can be tailored to meet the needs of any type of business, from a new solo freelancer to an established e-tailer. In 6 laminated pages, this concise user guide will have you running smoothly with knowledge of exactly where your finances are at any moment at a value that cannot be beat.

6 page laminated guide includes:

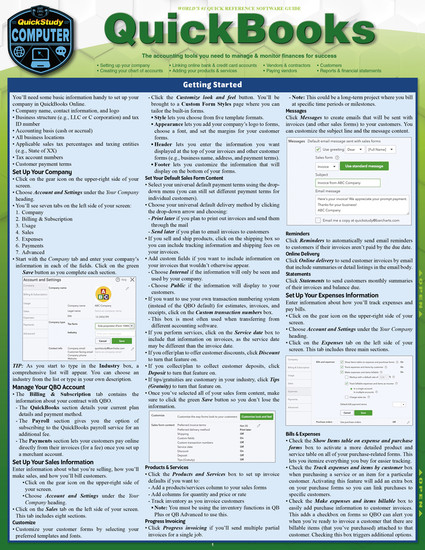

- Getting Started

- Set Up Your Company

- Manage Your QBO Account

- Set Up Your Sales, Expenses & Advanced Information

- Creating Your Chart of Accounts

- Customize an Account

- Delete an Account

- Add an Account

- Changing Accounts

- Linking Online Bank & Credit Card Accounts

- Link Your Accounts

- Import Your Transactions

- Adding Your Products & Services

- Create an Inventory & Non-Inventory Item

- Create a Service Item

- Create a Bundle

- View a List of All Products & Services

- Vendors & Contractors

- Set Up a Vendor

- Import Multiple Vendors

- Make Changes to a Vendor Profile

- Delete a Vendor

- Set Up a Contractor

- Enter Vendor Bills

- Paying Vendors

- Pay a Vendor with QBO Bill Pay

- Pay a Vendor with a QBO Check

- Pay Vendors through Connected Bank & Credit Card Accounts

- Enter Other Vendor Payments

- Customers

- Setting Up a Customer

- Import Multiple Customers

- Make Changes to Customer Information

- Delete a Customer

- Invoice Customers

- Receive Payments from Customers for Invoices

- Deposit “Undeposited Funds”

- Reports & Financial Statements

- Create Reports & Financial Statements

- Run Accounts Receivable Reports

- Run Accounts Payable Reports

- Run Financial Statements

- Invite Your Accountant to Your QBO Account